10 Signs That You’re Ready to Buy a House

Thinking of purchasing a new home? Read this first!

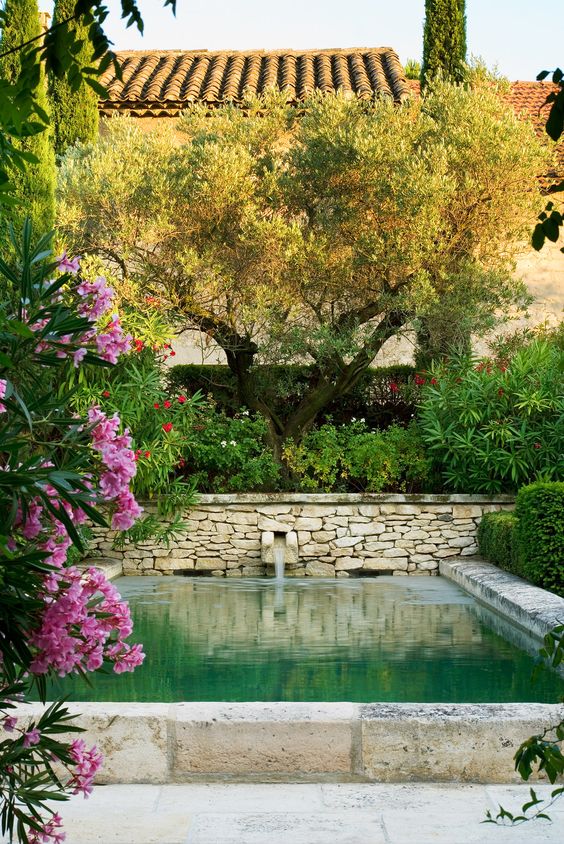

Photo: The Enchanted Home

In life, we have a lot of big decisions to make. It includes your educational course, job, marriage and much more. Buying a house can also be considered as one of those. Buying a new house is indeed one of the biggest milestones in someone’s life. Chances are you will only have to buy a house once in your lifetime and you will be living in that house for a very long time.

That is why choosing the best house for you is critical for your long term happiness and comfortability. If you are faced with that decision, you may have mixed feelings since it could be one of the most exciting yet stressful times of your life. You have to be both mentally and financially stable to be able to take that next step and purchase your own house.

But how can you make sure that you are ready? The list below by Pedersens will surely help you decide on what path to take.

Photo: The Style Saloniste

You Have Positive Cash Flow

Positive cash flow means that your income is always greater than your expenses. You should also be free from any kinds of debts. Even if you think that you can be able to pay your house monthly while having other debts, have you already considered the expenses your new house will incur like utility bills, property tax, homeowner’s insurance, and repair and maintenance expenses?

You’ve Researched Mortgage Options

If you think there is only one way to buy a new house, you are wrong. There are actually plenty of means to get your own property like the 30-years mortgage and special loans for veterans and farmers. If you are able to find the exact fit for you, you are well on your way to getting your new house.

Photo: W Glandscape

Have a Good Credit Score

If you have a good credit score, the financial institution will deem you as a low-risk customer. And it will result in lower mortgage rates. On the other hand, a low credit score often leads to your mortgage being denied. So if you are looking forward to buying a house in the future, gradually increase your credit score.

You Have Saved Enough for the Down Payment

You may be enticed with the idea of low down payment house because you don’t have much savings for bigger down payment. If this is the case, you have to slow things down a bit. Low down payments can only mean higher monthly rates and it is more stressful to deal with. If you can pay 15-25% of the total cost of the house, it will be much better because it will position you to a better financial status in the future.

Steady Job

Although unforeseeable circumstances can really affect your job, you still must have a security of tenure in your work so you are sure that you can back up all the financial outflow of buying a house. The longer you are in your current company, the more likely you’ll keep your job by yourself.

A Rise in Income

When buying a house, you still have to consider your other daily needs. You don’t want your monthly mortgage to be higher than 30% of your total income, do you? Although some allocate 50% of their salary to buy a new house, you should be ready to sacrifice your current lifestyle and be contented to a lean one. The other choice is to look for additional ways to earn money to support your monthly payment and your daily living.

Your City is Truly Your Home

It is always a bad idea to buy a new house in a place you do not really want. You should always be certain that you love the city you are planning to purchase your property to stay there for good. Consider the weather, the culture of the people, and their lifestyle and make sure it will fit yours so you can be comfortable for the rest of your stay there.

You’ve been Renting Long Enough

Many people get too busy in their lives and are already contented to just renting their house. But when you step back and assess all the payments you have made to a property that will never be yours, you can already have been living in a house that you can call yours. So if you are renting long enough, is it already the perfect time to decide to buy your own house?

You Want to Take Advantage of Equity

Unlike cars and machinery, the equity of your own home appreciates over time. To put it simply, the equity of your house can be compared to bank savings because the gap of your debt and the gap of your equity widens over time. You can use this to fund your college expenses, prepare for your retirement, or just have liquid assets when an emergency happens.

You Want to Settle Down

Settling down can be exciting. Why? This can mean that you want to build your own family or you see yourself to be still in your current job for many years to come. Whatever your inspiration to settle down is, it may be the perfect

Leave a Comment